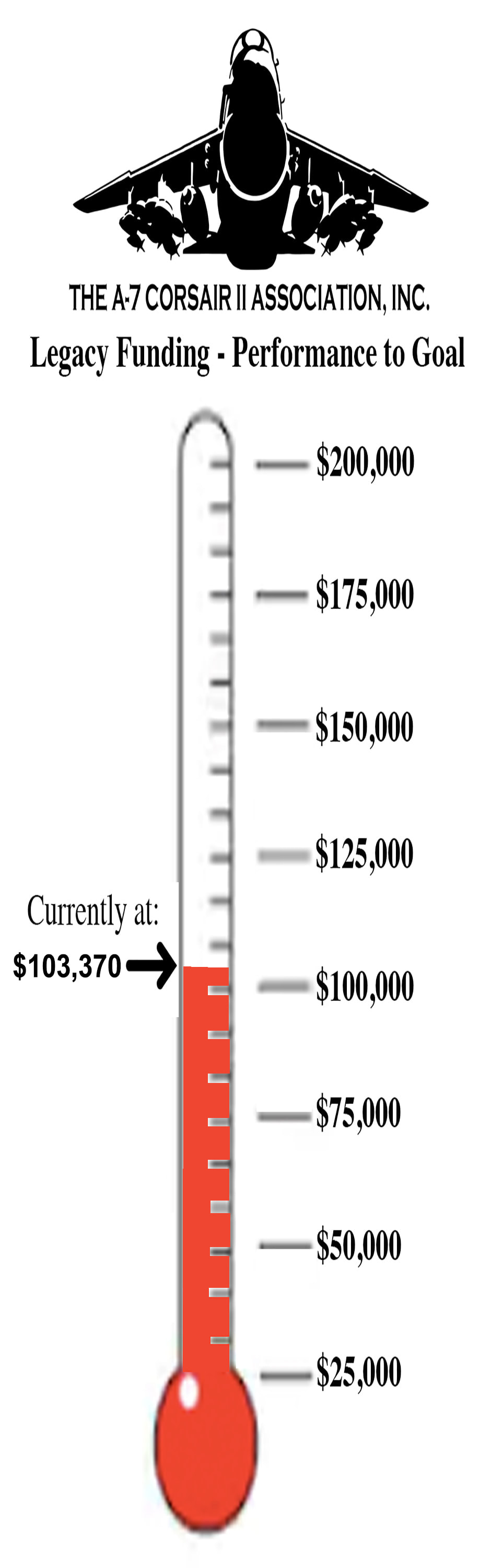

The goal of the Legacy Fund is to provide the necessary funds to maintain the heritage of the A-7 and to

support memorial projects as well as STEM education for aspiring aviators. Your support in building our

endowment will ensure that future generations will understand and appreciate the critical role the A-7 Corsair II

played in the service to our armed forces.

***

LEGACY FUND COMMITTEE MEMBERS:

Bill “Whiteshoes” Johnson

Bill “BT” Thomas

Bill “BJ” Minkoff

Pete “Smurf” Murphy

John “Cooch” Cardonia

WHAT'S IT ALL ABOUT?

Please take a moment to watch the short video below.

Narrated by William "White Shoes" Johnson, the video details the Legacy Fund plans.

Make sure that the volume is up on your computer before starting.

- FREQUENTLY ASKED QUESTIONS -

If you have any additional questions please email them to Jeep at Jstivers49@gmail.com or Shoes at ytshuz81@gmail.com

Q. Why do we have a Legacy Fund?

A. The Legacy Fund will insure that the mission of the A-7 Corsair II Association will continue after pilots, maintainers and associated cadre are no longer able to engage.

Q. Where does the money I donate go?

A. The funds raised for the Legacy Fund are deposited to a separate account overseen by the Legacy Fund Committee.

Q. How am I sure my money will be used for the Legacy Fund?

A. All funds will be accounted for separately and expressly used to execute the Legacy Fund project. Ultimately, proceeds from the Legacy Fund for projects such as National Flight Academy STEM scholarships, college scholarships, and A-7 history when membership shrinks to the point that dues and direct donations cannot support our work.

Q. Who is the Legacy Fund Committee?

A. The Legacy Fund Committee is composed of 5 members, 3 of which are current Association Board members and two who are members but not on the Board.

Q. Who will manage the A-7 Corsair II Association Legacy Fund once we are all gone?

A. The Legacy Fund Committee operates independently of the Association and because members are engaged with the Association it will continue to function indefinitely.

Q. Who has oversight over the Legacy Fund Committee?

A. The Board of Directors has oversight over both investments and dispersal of Legacy funds.

Q. How are the funds managed?

A. Currently liquid funds are kept in a Vanguard Brokerage account and are invested in a reduced volatility fund. Long-term funds will be used to purchase Indexed Universal Life Insurance (IUL) used to build cash and future payouts.

Q. What is an Indexed Universal Life and why do we have one?

A. An Indexed Universal Life Policy is a life insurance policy placed on a member of the Association. It offers multiple opportunities for investments specifically designed to provide long-term equity build-up and a death benefit payable to the Association.

Q. You mentioned Vanguard Index Fund what is that and how much money is in it?

A. The long term goal is to have approximately one-third of the Legacy Fund invested in The Vanguard Index Fund. The fund is the industry’s first index fund for individual investors, the 500 Index Fund is a low-cost way to gain diversified exposure to the U.S. equity market. The fund offers exposure to 500 of the largest U.S. companies, which span many different industries and account for about three-fourths of the U.S. stock market’s value. The key risk for the fund is the volatility that comes with its full exposure to the stock market. Because the 500 Index Fund is broadly diversified within the large-capitalization market, it may be considered a core equity holding in a portfolio. Vanguard 500 Index Fund Admiral Shares (VFIAX)

Q. What are STEM programs and who participates?

A. The Association supports the Science Technology Engineering and Math, STEM program at the National Flight Academy, a camp for rising 7 th grade – 12 grade. It is onboard NAS Pensacola and is located adjacent to the Naval Aviation Museum. The camp delivers “inspired play” in 6 day immersive program. It all starts with the story— a heart-pumping, adrenaline-filled mission with squadrons competing to successfully finish a task. Whether it is a race or rescue, science, technology, engineering, and math (STEM) skills are used in tandem with the equally important 21st Century learning skills including critical thinking, problem-solving, teamwork and communication to advance the team.

Q. What is our goal and how much money is needed to achieve our objectives?

A. Our goal is to fund several Indexed Universal Life Insurance policies with premiums of $20,000 each year for 10 years. Additional funds raised will be placed in a Vanguard Index Fund as a reserve until such time as they can be invested in additional IUL policies.

Q. The presentation states a need for $30,000/yr for 15 yrs but the premiums are only $20,000/yr. What is the rest of the money for?

A. The total goal of $30,000 per year will ensure that the following goals are met. A contribution of $5,000.00 each to four Indexed Universal Life Insurance accounts and an additional $10,000 per year going to the Vanguard Admiral Indexed Fund. The Vanguard fund serves two functions. It provides a cushion to ensure we can continue to meet the annual premiums in the event donations fall short in some years and it provides extra funds as a hedge against inflation over the next 20 years until the Association receives benefits from the policies. This will allow us to continue to execute our normal operations such as scholarships, historical preservations, and legacy projects without raising our dues.

Q. In the presentation it states the there will be two policies but I have heard that there will be four. Which is correct?

A. Our initial plan entailed spending $20,000 per year for two policy premiums. We have amended the number to four $5,000 premiums in order to better diversify our investment. There are a couple of advantages to this; It will allow us to spread out our premiums and statistically it will spread out the benefits.

Q. Is it possible to set up my own IUL?

A. Yes the Association is working with Nationwide Insurance to provide access to a portfolio of options for our members. Please contact Bill Minkoff, 1st Vice President if you would like to receive more information.

Q. What are the other ways I can donate to the Legacy Fund.

A. Individuals who have IRAs or 401k(s) and are subject to a mandatory distribution may have all or a portion of their funds distribution sent directly to The Association. Such distributions may be contributed tax-free. You should consult with your tax professional for pertinent rules and information.

A. The Legacy Fund will insure that the mission of the A-7 Corsair II Association will continue after pilots, maintainers and associated cadre are no longer able to engage.

Q. Where does the money I donate go?

A. The funds raised for the Legacy Fund are deposited to a separate account overseen by the Legacy Fund Committee.

Q. How am I sure my money will be used for the Legacy Fund?

A. All funds will be accounted for separately and expressly used to execute the Legacy Fund project. Ultimately, proceeds from the Legacy Fund for projects such as National Flight Academy STEM scholarships, college scholarships, and A-7 history when membership shrinks to the point that dues and direct donations cannot support our work.

Q. Who is the Legacy Fund Committee?

A. The Legacy Fund Committee is composed of 5 members, 3 of which are current Association Board members and two who are members but not on the Board.

Q. Who will manage the A-7 Corsair II Association Legacy Fund once we are all gone?

A. The Legacy Fund Committee operates independently of the Association and because members are engaged with the Association it will continue to function indefinitely.

Q. Who has oversight over the Legacy Fund Committee?

A. The Board of Directors has oversight over both investments and dispersal of Legacy funds.

Q. How are the funds managed?

A. Currently liquid funds are kept in a Vanguard Brokerage account and are invested in a reduced volatility fund. Long-term funds will be used to purchase Indexed Universal Life Insurance (IUL) used to build cash and future payouts.

Q. What is an Indexed Universal Life and why do we have one?

A. An Indexed Universal Life Policy is a life insurance policy placed on a member of the Association. It offers multiple opportunities for investments specifically designed to provide long-term equity build-up and a death benefit payable to the Association.

Q. You mentioned Vanguard Index Fund what is that and how much money is in it?

A. The long term goal is to have approximately one-third of the Legacy Fund invested in The Vanguard Index Fund. The fund is the industry’s first index fund for individual investors, the 500 Index Fund is a low-cost way to gain diversified exposure to the U.S. equity market. The fund offers exposure to 500 of the largest U.S. companies, which span many different industries and account for about three-fourths of the U.S. stock market’s value. The key risk for the fund is the volatility that comes with its full exposure to the stock market. Because the 500 Index Fund is broadly diversified within the large-capitalization market, it may be considered a core equity holding in a portfolio. Vanguard 500 Index Fund Admiral Shares (VFIAX)

Q. What are STEM programs and who participates?

A. The Association supports the Science Technology Engineering and Math, STEM program at the National Flight Academy, a camp for rising 7 th grade – 12 grade. It is onboard NAS Pensacola and is located adjacent to the Naval Aviation Museum. The camp delivers “inspired play” in 6 day immersive program. It all starts with the story— a heart-pumping, adrenaline-filled mission with squadrons competing to successfully finish a task. Whether it is a race or rescue, science, technology, engineering, and math (STEM) skills are used in tandem with the equally important 21st Century learning skills including critical thinking, problem-solving, teamwork and communication to advance the team.

Q. What is our goal and how much money is needed to achieve our objectives?

A. Our goal is to fund several Indexed Universal Life Insurance policies with premiums of $20,000 each year for 10 years. Additional funds raised will be placed in a Vanguard Index Fund as a reserve until such time as they can be invested in additional IUL policies.

Q. The presentation states a need for $30,000/yr for 15 yrs but the premiums are only $20,000/yr. What is the rest of the money for?

A. The total goal of $30,000 per year will ensure that the following goals are met. A contribution of $5,000.00 each to four Indexed Universal Life Insurance accounts and an additional $10,000 per year going to the Vanguard Admiral Indexed Fund. The Vanguard fund serves two functions. It provides a cushion to ensure we can continue to meet the annual premiums in the event donations fall short in some years and it provides extra funds as a hedge against inflation over the next 20 years until the Association receives benefits from the policies. This will allow us to continue to execute our normal operations such as scholarships, historical preservations, and legacy projects without raising our dues.

Q. In the presentation it states the there will be two policies but I have heard that there will be four. Which is correct?

A. Our initial plan entailed spending $20,000 per year for two policy premiums. We have amended the number to four $5,000 premiums in order to better diversify our investment. There are a couple of advantages to this; It will allow us to spread out our premiums and statistically it will spread out the benefits.

Q. Is it possible to set up my own IUL?

A. Yes the Association is working with Nationwide Insurance to provide access to a portfolio of options for our members. Please contact Bill Minkoff, 1st Vice President if you would like to receive more information.

Q. What are the other ways I can donate to the Legacy Fund.

A. Individuals who have IRAs or 401k(s) and are subject to a mandatory distribution may have all or a portion of their funds distribution sent directly to The Association. Such distributions may be contributed tax-free. You should consult with your tax professional for pertinent rules and information.

Funding Options

Yes, I want to make a difference, and preserve the legacy of the A-7 Corsair II!

We would prefer that you write a check for your Legacy Fund donation...

Utilizing the PayPal options provided below, while fine, means that PayPal takes a percentage of your donation in processing fees. Sending your donation by check ensures that 100% of your donation goes to this worthy cause. Please make your check out to the A-7 Corsair II Association Inc., with "For Legacy Fund" in the memo section. Then mail the check to our Association Treasurer, Mike Leppert:

Mike Leppert

1010 Lakefront Court

Greensboro, GA 30642

Utilizing the PayPal options provided below, while fine, means that PayPal takes a percentage of your donation in processing fees. Sending your donation by check ensures that 100% of your donation goes to this worthy cause. Please make your check out to the A-7 Corsair II Association Inc., with "For Legacy Fund" in the memo section. Then mail the check to our Association Treasurer, Mike Leppert:

Mike Leppert

1010 Lakefront Court

Greensboro, GA 30642

TO PAY WITH A CREDIT CARD...

Via our secure PayPal portal. You do not need a PayPal account to use this function.

$1,000 Gift - Annual Installments

|

Using part of your Required Minimum

Deduction from your IRA at 70 1/2 for the

A-7 Legacy Fund

A-7 Folks, if you are 70 1/2 years old, you can use part or all of your minimum required deduction from your IRA to go directly to the A-7 Legacy Fund without you or the Legacy fund paying taxes on the donation. Details below about the way it works. It has to be a check written from your IRA funds Administrator to the A-7 Corsair II Association Inc Legacy Fund, in care of our Treasurer, Mike Leppert.

The A-7 is a qualified 501(c)(3) and our Fed EIN is 46-1898724. Mike's address and contact info is:

Mike Leppert

A-7 Corsair II Association Inc. Treasurer

1010 Lakefront Court

Greensboro, GA 30642

meleppert@gmail.com

How a Qualified Charitable Distribution Works - Normally, a distribution from a traditional IRA incurs taxes since the account holder didn’t pay taxes on the money when they put it into the IRA. But account holders 70½ or older who make a contribution directly from a traditional IRA to a qualified charity can donate up to $100,000 without it being considered a taxable distribution. The deduction effectively lowers the donor's adjusted gross income (AGI).

To avoid paying taxes on the donation, the donor must follow the IRS rules for qualified charitable distributions (QCDs), aka charitable IRA rollovers. Most churches, nonprofit charities, educational organizations, nonprofit hospitals, and medical research organizations are qualified 501(c)3 organizations.

This tax break does mean that the donor cannot also claim the donation as a deduction on Schedule A of their tax return. Even more information on MRW and QCDs are on the following link: https://www.investopedia.com/taxes/can-i-use-money-my-ira-donate-charity/

Mike Leppert

A-7 Corsair II Association Inc. Treasurer

1010 Lakefront Court

Greensboro, GA 30642

meleppert@gmail.com

How a Qualified Charitable Distribution Works - Normally, a distribution from a traditional IRA incurs taxes since the account holder didn’t pay taxes on the money when they put it into the IRA. But account holders 70½ or older who make a contribution directly from a traditional IRA to a qualified charity can donate up to $100,000 without it being considered a taxable distribution. The deduction effectively lowers the donor's adjusted gross income (AGI).

To avoid paying taxes on the donation, the donor must follow the IRS rules for qualified charitable distributions (QCDs), aka charitable IRA rollovers. Most churches, nonprofit charities, educational organizations, nonprofit hospitals, and medical research organizations are qualified 501(c)3 organizations.

This tax break does mean that the donor cannot also claim the donation as a deduction on Schedule A of their tax return. Even more information on MRW and QCDs are on the following link: https://www.investopedia.com/taxes/can-i-use-money-my-ira-donate-charity/